A reflection of the world we live in

Global financial market analysis

A reflection of the world we live in

A reflection of the world we live in

Global financial market analysis

The final Fed rate decision of this decade saw rates kept on hold

The Fed’s final interest rate decision of 2019 did not surprise many market participants. The policy rate remains at 1.5% – 1.75% and, unlike the previous FOMC meeting, there were no dissenters.

Interestingly, Powell also indicated that there was unlikely to be any changes to this policy rate throughout 2020. The market’s reaction was initially hawkish, however it quickly saw more dovish moves. It is clear that Fed is in no rush to reverse the three ‘insurance cuts’ carried out in 2019, even if the economy picks up momentum and the chances of a recession fade. Powell also said that he wanted to see a significant and persistent move up in inflation before an interest rate hike. Therefore, the criteria for the next rate hike is substantial as the US has been experiencing relatively benign inflation for a prolonged period of time.

This dovishness was reflected in the ensuing market moves; US stocks and Treasuries saw gains, with the S&P 500 rising by 0.29% and the yield on the Treasury note fell below 1.8% (Financial Times).

As oppose to a rate hike, I see the chance of a further rate cut as a more likely outcome in 2020. Several geopolitical risks still persist, including the viable threat of another round of escalation in the US-China Trade War that would weigh on an already sluggish global economy.

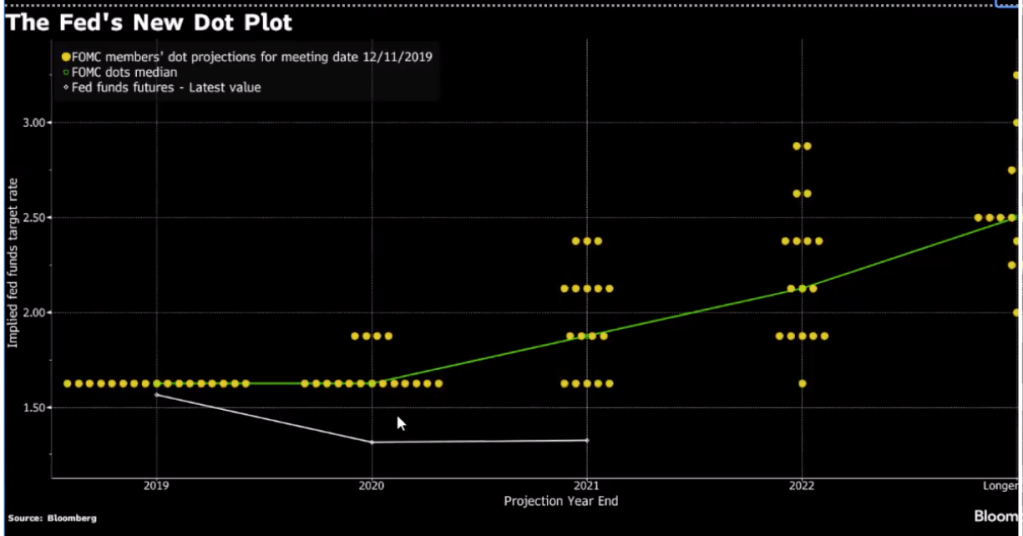

The update Fed Dot Plot matrix confirms this. The median projection line is noticeably shallow, indicating that rate changes going forward will only be very gradual. This makes sense given the issue of persistent lagging inflation; markets believe that even in five years, US inflation will not exceed 1.8% (Financial Times).

Mario Draghi rocks markets in his penultimate interest rate meeting as ECB President

Thursday 12th September saw Mario Draghi cause a stir in the financial markets. Firstly, he announced a 10 basis points cut of the deposit rate, bringing it further into negative territory at -0.5%.

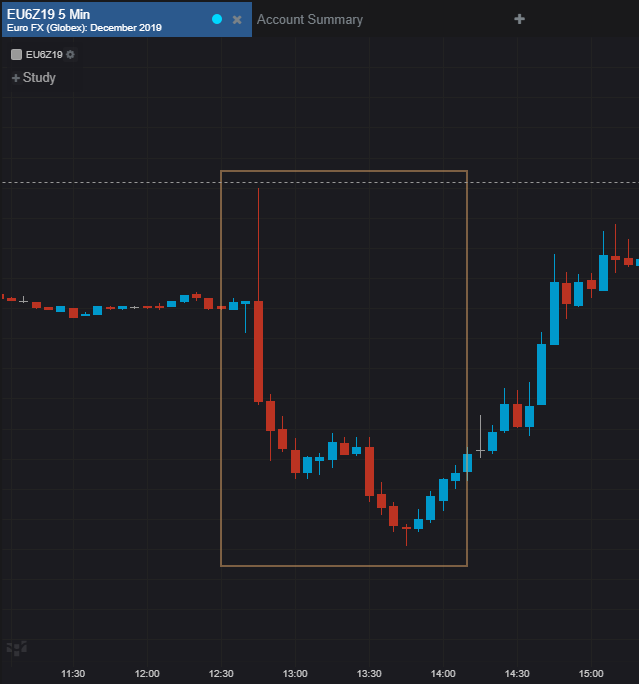

Initially, the market saw this as a slightly hawkish event as those priced in for a 20bp cut unwound their positions. This saw the Euro strengthen significantly. However, this was followed by a major move downwards for the Euro. Why was this?

Well this initial hawkish move was offset by significant accomodative policy. Draghi announced a tiering system that exempts part of banks’ excess liquidity from negative rates (Bloomberg, September 2019). He also scrapped calendar-based future guidance, citing current rates or lower until inflation “robustly” converges on goal. Most significantly of all, Draghi dropped a QE bomb shell. As of 1 November, the ECB is restarting their QE programme at €20 billion per month – but with no set end date! The QE programme will continue until just before the first rate hike! This extremely accomodative policy prompted a typical dovish reaction in the markets, seeing the Euro weaken significantly against the dollar. However, Draghi’s re-introduction of QE was not without its critics.

There was notable acrimony to the re-introduction of QE from some of Europe’s most important members. Germany, Austria, Netherlands, France and Estonia all opposed it. They believe that the action was disproportionate to the economic situation Europe find themselves in. This is particularly worrying given the lack of monetary policy ammunition available to the ECB, especially given that economists are predicting a recession in the coming years. This poses a real challenge for Christine Lagarde as she inherits a Europe divided on the best course of action given the current political landscape.

For a matter of months now, it can be strongly argued that Trump had been playing (reasonably successfully) the puppet-master, keeping the financial markets on strings, dancing to his ever-changing tune.

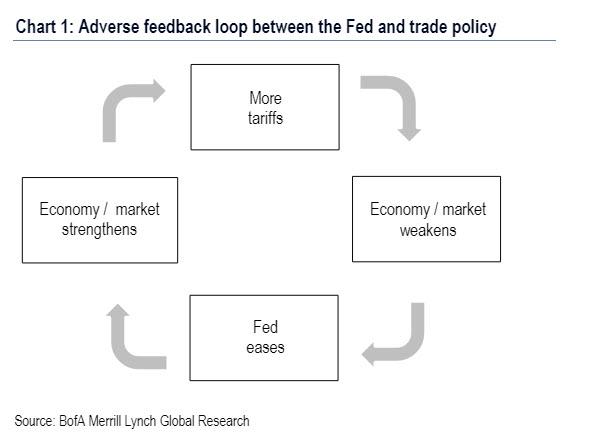

This can be summarised by the adverse feedback loop, seen above. By Trump imposing more tariffs on Chinese goods, the economy weakens as a direct consequence of escalating trade tensions. The Federal Reserve is then seen to have to accelerate policy easing to re-strengthen the markets. Trump is singularly the catalyst for market movement a lot of the time, and this is something he is very much aware of and benefits from. However, is he losing his grip on the situation?

It could be argued that to this point, both America and China had a relatively equal-footing with respect to the trade war, and perhaps America even had the upper hand. Trump aggression was met with Chinese retaliation and Trump de-escalation was met with Chinese de-escalation of the trade tensions. However, it would appear that Trump’s lack of commitment to a single rhetoric and his constant flip-flopping has seen China’s patience finally run thin. Mere days after a hostile Twitter rant which saw the announcement of an additional tariff increase of 5% on imports from China (BBC, August 2019), Trump, while attending the G7 conference in Biarritz, then went on to say that both the US and China had held positive phone conversations and both had a strong willingness to strike a deal. This supposed phone call was actually denied by a representative of Chinese state media. Several Chinese analysts have cited deepening distrust with Trump as a huge obstacle to any immediate trade resolution and that China are no longer taking Trump’s rhetoric seriously; they are now preparing for worst-case scenarios. In my opinion, this is the first time in the Trade War dispute that I see a significant shift in power away from America and onto China. Remember that China had carefully managed their currency and successfully de-sensitised the market to the psychological level of 7 Yuan per Dollar. This has allowed them to weaken their currency in the last couple of weeks without disastrous mass capital outflows.

Furthermore, it would appear than the Federal Reserve are also not on Mr Trump’s side. Bill Dudley, the former head of the New York Fed and former vice-chair of the Federal Reserve, came out with a column that was highly scathing of Trump and suggested that the Federal Reserve act against him in order to dampen his re-election hopes in 2020 (Bloomberg, August 2019). Although he is not a part of the Federal Reserve and the Fed has come out to say that they are independent of politics, there still remains a feeling that the Federal Reserve are not inclined to assist Trump to the best of their ability.

Should both China and the Federal Reserve no longer play ball with Trump, it could spell major problems for the president. It would mean a break in the adverse feedback loop that had previously served the President so well. This would mean that Trump would be forced to soften his stance with the Federal Reserve and China, which may appear as a sign of weakness that would not go down well with some of his supporters in the run-up to the next presidential elections.

31st July 2019 – Fed cuts rates for first time since 2008

Wednesday 31st July 2019 saw the long-awaited Fed interest rate decision, and it didn’t disappoint…unless you’re Trump of course.

To gauge an understanding of some of the reasons for the market reaction of the decision, we must first look at the market sentiment coming into the meeting. Markets were virtually 100% priced in for a rate cut, the only question was as to whether it would be by 25 or 50 basis points. Minutes from last month’s FOMC meeting indicated that Fed officials saw a stronger case for “somewhat more accommodative policy…”. Powell also recently mentioned the interconnectedness of the US economy with the rest of the world (Financial Times, July 2019) and slowing global growth, as indicated by the recent downgrade by the IMF, suggested a dovish bias for the Fed.

I, along with 76% of the market, believed that a rate cut of 25 basis points would occur, as oppose to 50. The miscommunication by Clarida and Williams (covered in my previous post) had stoked market expectations of a 50 basis point cut before the NY Fed reversed most of this move. Furthermore, sources in the Wall Street Journal stated that Fed officials were not prepared to cut by 50 as recent economic developments did not indicate it was necessary to do so. Several other factors suggested a 25 point cut, such as the rising Citi economic surprise index and the fact that the Fed has never cut 50 without there being a financial crisis. However, markets were priced for multiple rate cuts for this year following this one, therefore the future guidance that accompanied the interest decision was of paramount significance.

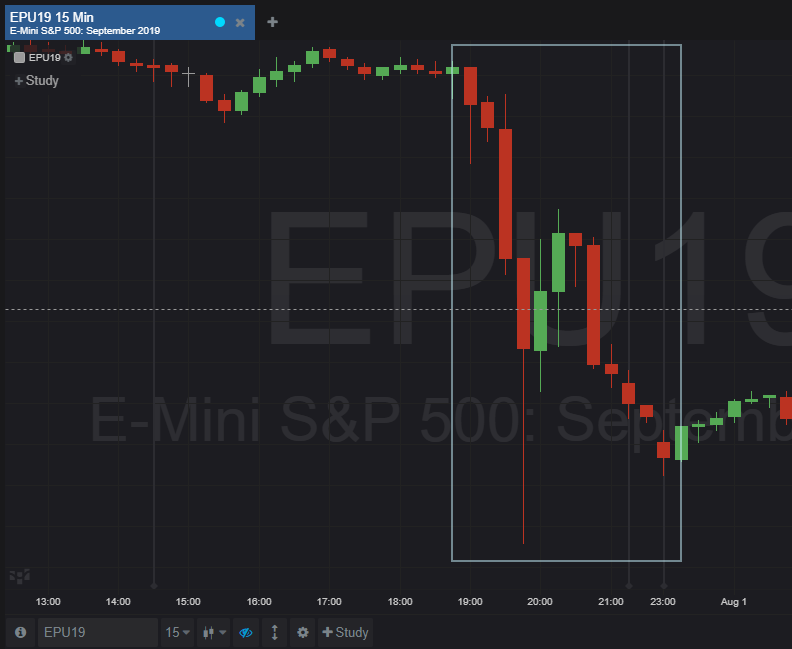

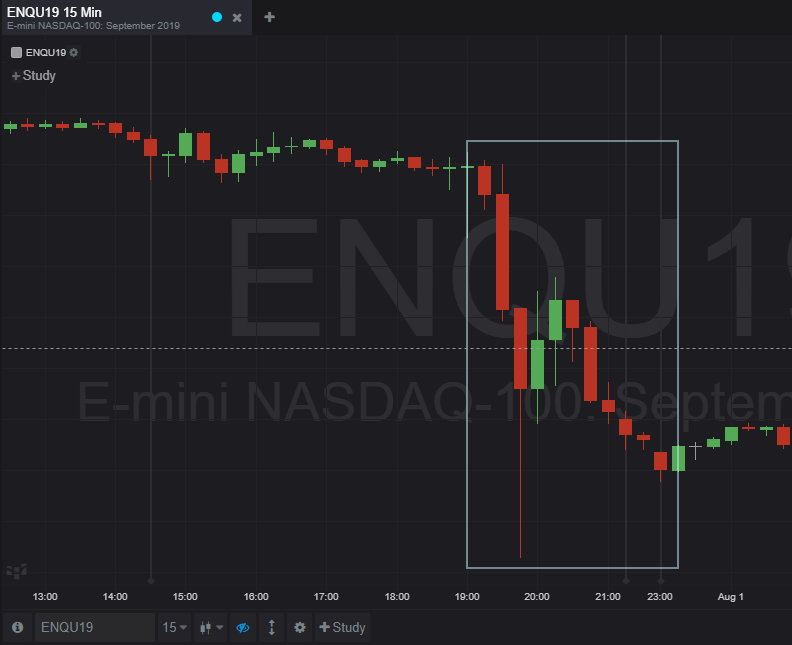

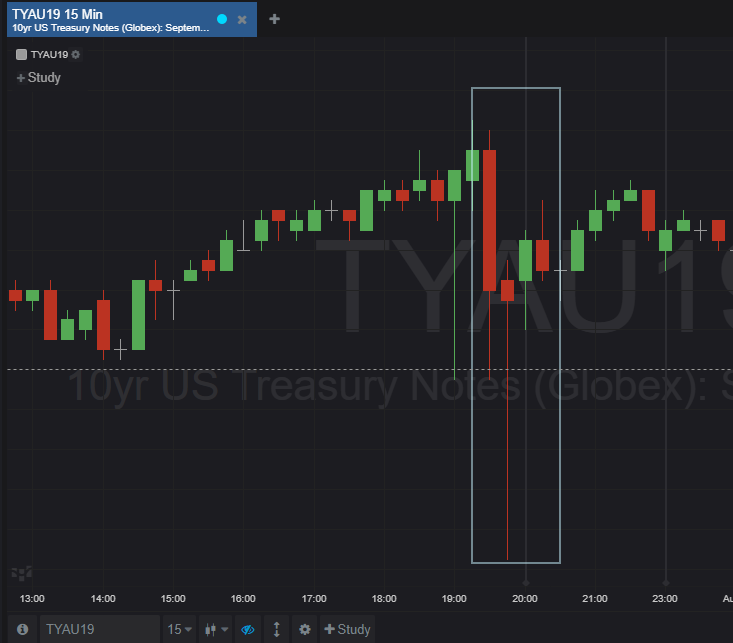

At 7pm London time, Powell announced a rate cut of 25 basis points.

Initially, there was a hawkish reaction as those who had priced in a 50 basis point cut unwound their pricing. Equities and Gold fell sharply as the dollar strengthened and yields rose. There were also two dissenters in the form of Ester George and Eric Rosengren, adding further hawkish stimulus. However, equities and treasuries saw a slight pullback after the initial drop. This was because the Fed had announced that they would be ending quantitative tightening one-month early. This dovish announcement mitigated some of the initial hawkish sentiment.

The markets then waiting on tenterhooks for Jerome Powell’s press-conference and the Fed’s future guidance.

Powell’s press-conference and Q&A session had caught the market by hawkish surprise. He remarked: “We are thinking of it as essentially in the nature of the mid-cycle adjustment to policy” and signaled that the rate cut was not necessarily the beginning of a long easing cycle as well as stating that the outlook for the US economy remains favorable. This indicated that the 25bp cut was perhaps an insurance cut rather than a commitment to subsequent cuts. Powell’s words were perceived as quite hawkish and the markets reacted in kind…

Major equity indices such as the S&P 500, NASDAQ and the Dow Jones fell significantly. The DXY rose and gold fell on the back of a strengthening dollar. The EUR/USD futures fell from 1.11815 pre-decision to a low of 1.10720 the following day.

Some suggest that the Fed got this wrong and that the US is more late-cycle than mid-cycle, and therefore should have taken steps in consideration of this. There is no greater critic of Powell than Mr Trump, who had made no secret his desire for the start of aggressive rate cuts. This strengthening dollar and weakened euro makes Germany more competitive as an exporter, much to the dismay of Donald trump. Furthermore, the decline in the US stock indices would have been sure to further aggravate the president. However, given the largely positive US economic date and the Fed’s limited room for manoeuvure, I believe that Powell has, on the whole, made the right decision.

Clarida and Williams stir the markets following comments on interest rate cuts

Friday 19th July 2019 saw me wake up to news that two prominent Fed officials had caused a stir within the financial markets after their remarks concerning interest rate cuts.

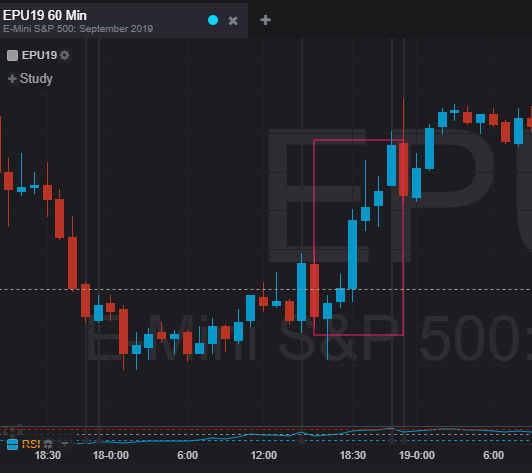

Clarida, the Fed Vice-Chairman, expressed that “you don’t need to wait until things get so bad to have a dramatic series of rate cuts”. Following this, the New York Fed Chief John Williams remarked “when you only have so much stimulus at your disposal, it pays to act quickly to lower rates at the first sign of economic distress” (Bloomberg, July 2019). This marked a significant change in Fed communication, suggesting an even more aggressively dovish tone from the Fed than was previously anticipated. The markets reacted in kind. The probability of a 50 basis point cut had jumped from 28% to 48% within the space of a month (CME Group, July 2019).

On the back of this apparent more dovish tone from the Fed, S&P 500 futures, gold and EUR/USD all had a big push on the upside and treasury yields fell. However, in each case, the upside movement in prices preceded a drop soon after. This drop was particularly prominent in the case of EUR/USD and US bond prices. So, what was the reason for this?

The answer lies in what followed the remarks made by the key Fed officials. The official New York Fed spokeswoman came out and clarified that Williams’ comments were merely academic and did not constitute an insight into the potential policy action at the upcoming FOMC meeting (xtb, July 2019). In my opinion, the fact that the Fed took the highly unusual step of having the official NY spokeswoman come out with such clarity is telling. It seems that the Fed was trying to communicate that the market had over-positioned itself following the comments, and therefore I believe that a 25 basis point cut is still very much the most likely course of action for the 31st July meeting. In other words, the Fed had made a serious error in their communication. I use the word ‘serious’ for good reason.

The Fed is now facing a problem. As virtually half of the market is expecting a 50 basis point cut, delivery of a 25 basis point cut will most likely see a hawkish reaction in the markets initially despite the policy action being expansionary. Equities, EUR/USD and gold will likely fall and yields may actually spike. Therefore we may see the Fed use forward guidance in the coming days (in the form of other Fed speakers) to realign market expectations before the looming official blackout period is beyond us.

Hey! Just a bit about myself…

I am a student currently studying Accounting & Finance at the University of Bath with an interest in geo-politics and the financial markets.

The reason I decided to create this blog is to share my analysis of major market-moving events from a collection of what I have read. Of course, my reflections will not provide the same depth that a seasoned-professional may, but I hope it proves interesting to at least some!